Fringe Advantageous assets to Add to Medicare Wages within the Measuring Payroll Will set you back

Partnerships is utilize the exact same methodology because the more than however, complete an effective Setting 1065 when you look at the Step 1 and replace websites cash in on Step dos toward web income of worry about-a career each personal U.S.-built standard couples (the essential difference between package 14a out-of Irs Setting 1065 K-step one plus the sum of (i) one area 179 debts deduction said in box several; (ii) people unreimbursed connection costs stated; and you may (iii) people destruction stated toward gas and oil characteristics) increased 0.9235. Documentation criteria are the same once the above but Setting 1065 given that completed must be considering unlike Schedule C.

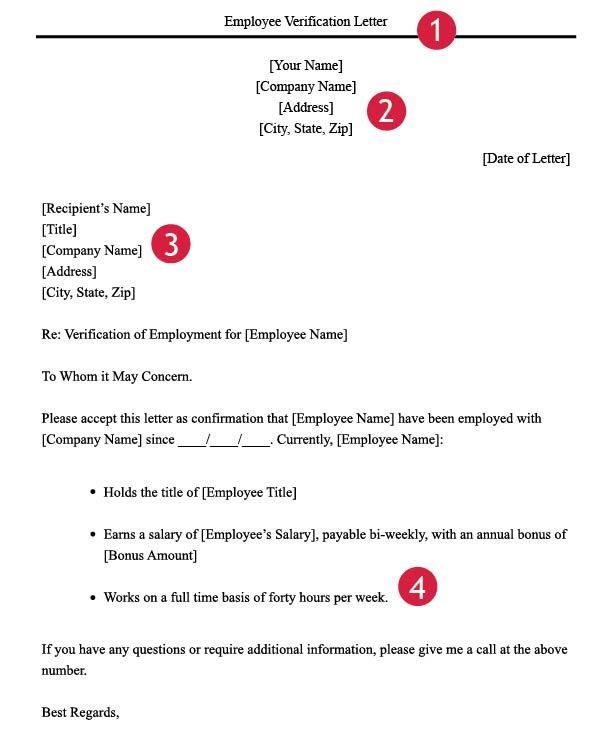

Matter a dozen outlines pre-tax staff member contributions pertaining to perimeter experts that are omitted away from Medicare wages that are additional back again to compute bucks compensation:

a dozen. Question: In addition to pre-taxation employee benefits to possess medical insurance, which are the most other pre-taxation personnel contributions to possess fringe masters which can was in fact excluded from Irs Setting 941 Nonexempt Medicare wages  information which is part off staff disgusting pay?

information which is part off staff disgusting pay?

Answer: Staff member contributions and you will write-offs away from pay for versatile purchasing plans (FSA) and other nontaxable gurus under a part 125 cafeteria package, certified transit or parking professionals (to $270 1 month), and you may group life insurance (for $fifty,one hundred thousand out of exposure) might have been omitted of Irs Means 941 Nonexempt Medicare wages resources. However, pre-income tax staff member benefits so you’re able to old age plans are part of Taxable Medicare earnings resources and cannot be included in you to figure so you can arrived at gross spend.

Federal Taxes and you can Payroll Will set you back

thirteen. Question: Just how should a debtor account fully for federal taxation whenever choosing the payroll prices for reason for the most loan amount, allowable uses of a PPP loan, and number of a loan which are often forgiven?

Answer: Payroll costs are calculated on the a terrible foundation rather than reference to federal taxation enforced otherwise withheld, such as the employee’s and you will employer’s share out of Government Insurance rates Efforts Operate (FICA) and you can income taxes needed to become withheld from professionals. This means that, payroll costs are maybe not less by the fees enforced with the a worker and you will needed to getting withheld of the workplace. not, payroll costs do not range from the employer’s share of payroll tax. For example, the income away from a member of staff who earned $4,one hundred thousand monthly in gross wages, of which $500 when you look at the federal taxes try withheld, amount because $cuatro,100000 from inside the payroll costs. not, the workplace-front federal payroll taxation imposed towards $4,000 during the earnings try omitted out-of payroll costs in law.

Limit into PPP Basic Draw Financing a corporate Group Can be Receive

fourteen. Question: Is there a threshold on money level of Basic Mark PPP Fund a corporate class can discovered?

Answer: Yes, companies that are part of a similar business category you should never discover Earliest Mark PPP Funds from inside the a whole amount of more $20 million. To own purposes of it maximum, businesses are element of one business classification if they are bulk possessed, physically otherwise indirectly, because of the a common mother or father.

“Salary Safety System Ideas on how to Determine Restrict Financing Number to possess Basic Mark PPP Loans and you may What Documents to provide – By Providers Type of,” SBA FAQ, , (recovered )

“Salary Cover Program Tips Estimate Maximum Financing Wide variety to own Basic Mark PPP Financing and you can Exactly what Papers to add – By Business Variety of,” SBA FAQ, , p. 1

“Paycheck Protection System Tips Estimate Restriction Loan Number having Basic Draw PPP Financing and you can What Documentation to include – From the Providers Method of,” SBA FAQ, , p. step one

“Salary Cover Program Tips Assess Maximum Financing Quantity to possess Basic Mark PPP Money and you can Exactly what Files to include – Of the Business Form of,” SBA FAQ, , pp. 3-4